2025 Crypto: Maturity or Misdirection? - Reactions Explode

5|0 comments

Aptos (APT) saw a modest price bump of 2.4% to $1.90 recently, while the broader crypto market, as measured by the CoinDesk 20 Index (CD20), only added 1.5%. Not exactly earth-shattering. What's more interesting is the reported 40% spike in trading volume above its 30-day average. CoinDesk is calling it "institutional positioning ahead of larger moves." But is it really?

APT "Accumulation": Smoke and Mirrors?

Decoding the "Accumulation" Narrative The argument hinges on "muted price action" masking "underlying accumulation dynamics." In other words, someone—allegedly institutions—is buying a lot of APT without driving the price up significantly. The idea is that they're trying to avoid spooking the market or signaling their intentions too early. Fine. But let’s unpack that. First, a 40% volume spike is noteworthy, sure. But volume alone doesn't tell the whole story. We need to know *who* is buying and *why*. CoinDesk's technical analysis model "showed" this accumulation. Okay, but what data feeds that model? Is it on-chain data, exchange order books, or a proprietary blend of both? Details are suspiciously scarce. I've looked at hundreds of these "accumulation" claims over the years, and they often boil down to someone with a large pile of tokens wanting to create a narrative that attracts more buyers. It's a self-fulfilling prophecy, if they can pull it off. But that doesn’t mean it's *real* institutional demand.Bitcoin's BOJ Blip: Macro Still Matters

The Bitcoin BOJ Blip: A Macro Reminder It’s easy to get caught up in the micro-analysis of individual tokens. But Bitcoin's recent stumble after the Bank of Japan hinted at raising interest rates is a timely reminder: macro forces still rule. A "dovish Fed" isn't a get-out-of-jail-free card for crypto. Global liquidity and risk appetite are still major drivers. So, even if there *is* some institutional interest in APT, it could be easily derailed by broader economic headwinds. And here’s the part of the report that I find genuinely puzzling: if institutions are truly accumulating, why is the price range so narrow? CoinDesk notes APT established higher lows within a measly $0.14 range. That's not exactly a sign of aggressive buying pressure. More like cautious nibbling. Immediate support is holding at $1.88, with resistance capping moves near $1.91. A 7.6% intraday range is "normal volatility," according to the report. But "normal" doesn’t scream “smart money” loading up the truck. It screams… well, normal trading activity.Crypto Adoption: Growth Doesn't Guarantee Gains

Adoption Rates: The Long Game Zooming out, broader crypto adoption is undeniably growing. A recent report suggests 28% of American adults now own cryptocurrency, up from 15% in 2021. That's a significant jump. And 14% of non-owners are reportedly planning to enter the market this year. This could be interpreted as bullish for all crypto assets, including APT. But let's be real: adoption doesn't automatically translate to price appreciation. It means more people are exposed to the asset class, which also means more potential sellers when the market turns south. Plus, the report highlights a gender disparity: 67% of crypto owners are men. This isn't necessarily a problem, but it does suggest there's still a large segment of the population that remains largely untapped. A "Whale" of a Doubt The APT narrative feels… manufactured. The data points to modest gains, a slight volume increase, and a vague claim of "institutional accumulation" based on a black-box technical analysis model. Until we see concrete evidence of *who* is buying *how much* and *why*, I'm filing this under "wait and see." The burden of proof is on the bulls to show that this isn't just another pump-and-dump scheme disguised as smart money.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

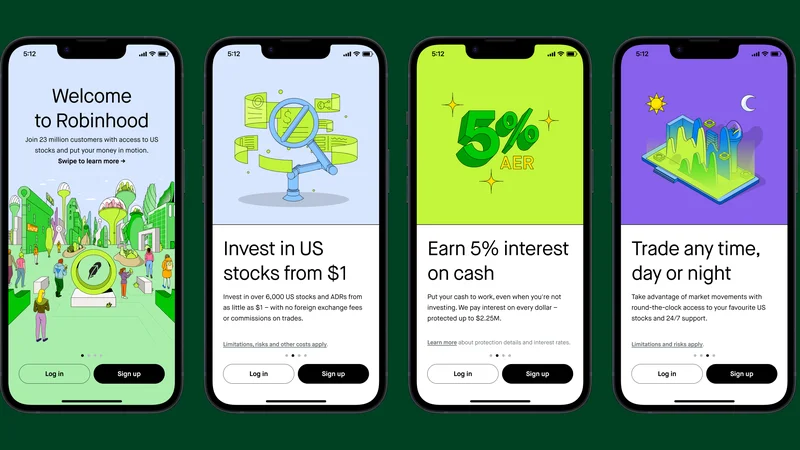

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Crypto's Future: The Suits Are Taking Over. (- Thoughts?)

- Asian Markets Mixed, US Stocks Up on Yields & Bitcoin: Parsing the Numbers

- 2025 Crypto: Maturity or Misdirection? - Reactions Explode

- Pink Pineapple: Benny Blanco's Latest Marketing Stunt. (Pineapple Mania!)

- Bitcoin Stuck at $86k: Bond Market Meltdown and Japan's Rate Hike Fears

- Shipping: The Economy's Unseen, Critical Bottleneck. (Reddit Weighs In)

- Fintech 2025: Are These 'New Waves' of Innovation, Security, and UX Just More BS?

- DeFi's 'Recovery': Are Investors Delusional? - Reddit's Take

- Why Crypto Market Analysis is Flawed (Reddit's Take)

- Saylor Won't Back Down: Bitcoin's Unstoppable Future - Saylor Stays Bullish

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)