Asian Markets Mixed, US Stocks Up on Yields & Bitcoin: Parsing the Numbers

9|0 comments

Asian markets are a mixed bag today. Tokyo’s Nikkei 225 is up 1.6%, hitting 50,063.65, fueled by gains in Tokyo Electron (up 5.6%) and Adventest (surging 6.9%). South Korea's Kospi is also in the green, rising 1.2% to 4,042.40, with Samsung Electronics adding 1.8%. But the Chinese markets are singing a different tune, dragged down by weak factory activity data. Hong Kong's Hang Seng is down 1.1%, and the Shanghai Composite shed 0.3%.

The most eye-catching move, however, is SoftBank Group Corp., which jumped over 8% following reports that Masayoshi Son regrets selling Nvidia shares. That’s a big headline, but let’s unpack the numbers.

SoftBank's Nvidia Regret: Vision or Liquidity?

The Nvidia Trade: A Regrettable Exit? SoftBank sold Nvidia shares for $5.8 billion last month. The immediate question is: why? Details on the exact rationale behind the sale remain scarce, but the timing is… interesting, to say the least. Nvidia's stock has continued its upward trajectory, and now Son is reportedly kicking himself. Is this just sour grapes? Or is there a genuine strategic misstep here? Let's put it in perspective. That $5.8 billion could have been significantly more if SoftBank had held onto those shares, especially given Nvidia’s position in the AI boom. The opportunity cost here isn’t just theoretical; it’s a very real, quantifiable figure. We're talking about potentially missing out on billions more in gains. The key question is whether SoftBank needed the cash or if Son simply misjudged Nvidia's potential. If it was a liquidity issue, then the sale, while regrettable in hindsight, might have been necessary. But if it was a bet against Nvidia that went wrong, then it's a far more serious indictment of SoftBank's investment strategy. (And this is the part of the report that I find genuinely puzzling – SoftBank is supposed to be the visionary, not the short-sighted player.)Signet's Warning: A "Measured" Consumer Environment?

Market Reactions and Broader Trends Elsewhere, the U.S. market is holding steady. The S&P 500 rose 0.2% to 6,829.37, the Dow added 0.4% to 47,474.46, and the Nasdaq gained 0.6% to 23,413.67. Boeing soared 10.1% after its CFO talked up growth expectations. MongoDB jumped 22.2% after a strong earnings report. But Signet Jewelers dropped 6.8% after forecasting weaker holiday revenue, anticipating a “measured consumer environment.” Signet’s forecast is particularly telling. They're bracing for a cautious consumer. That "measured consumer environment" is corporate-speak for "people aren't spending as much." This could be a canary in the coal mine, signaling a broader slowdown in consumer spending. The Fed has already cut interest rates twice this year, trying to goose the economy, but it’s unclear if it’s enough. Bitcoin's rollercoaster continues, rising to $94,000 after plunging below $85,000 on Monday. The volatility remains a major concern, making it a risky asset for the faint of heart. The 10-year Treasury yield edged down to 4.08% (from 4.09% yesterday). Small moves, but they indicate a slight shift towards safety. As Asian shares are mixed as steady bond yields, rebound for bitcoin push US stocks higher - Ottumwa Courier reports, Asian markets presented a mixed performance today. Son's Missed Call: A Billion-Dollar Head-Scratcher The SoftBank-Nvidia situation is more than just a bad trade. It's a case study in the perils of short-term thinking in a market driven by long-term trends. Was it a necessary move, or an avoidable error in judgment? I'm leaning towards the latter. And that’s a billion-dollar head-scratcher.-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

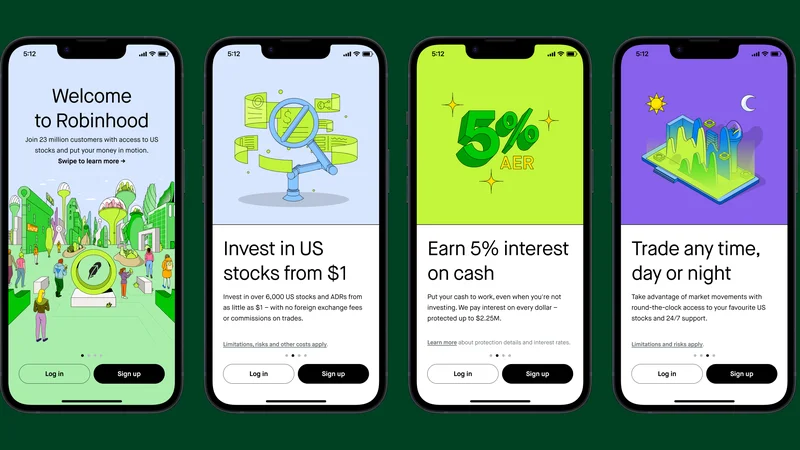

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Crypto's Future: The Suits Are Taking Over. (- Thoughts?)

- Asian Markets Mixed, US Stocks Up on Yields & Bitcoin: Parsing the Numbers

- 2025 Crypto: Maturity or Misdirection? - Reactions Explode

- Pink Pineapple: Benny Blanco's Latest Marketing Stunt. (Pineapple Mania!)

- Bitcoin Stuck at $86k: Bond Market Meltdown and Japan's Rate Hike Fears

- Shipping: The Economy's Unseen, Critical Bottleneck. (Reddit Weighs In)

- Fintech 2025: Are These 'New Waves' of Innovation, Security, and UX Just More BS?

- DeFi's 'Recovery': Are Investors Delusional? - Reddit's Take

- Why Crypto Market Analysis is Flawed (Reddit's Take)

- Saylor Won't Back Down: Bitcoin's Unstoppable Future - Saylor Stays Bullish

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)