Shipping: The Economy's Unseen, Critical Bottleneck. (Reddit Weighs In)

7|0 comments

The "Most Beautiful Word" Just Nuked the Market

Donald Trump, a man who once declared "tariff" the "most beautiful word in the dictionary," has effectively used that word to deliver a gut punch to the global economy. On Wednesday, he announced tariffs of *at least* 10% on all foreign-made goods, grandiosely calling it "Liberation Day." The actual numbers are far more aggressive: 34% on Chinese goods, 46% on Vietnamese, and 20% on the European Union. It's a move so sweeping it makes his previous trade restrictions—steel, aluminum, Canada, Mexico, Chinese goods *again*, and foreign cars—look like mere appetizers.

The immediate market reaction? Predictable. Stocks tanked. Consumer sentiment soured. But beyond the knee-jerk response, the real question is: how much of this is bluster, and how much is a structural shift? Trump framed these tariffs as "reciprocal," but that's a blatant misrepresentation. They far exceed the trade restrictions imposed by America's partners. It's like calling a knockout punch a "friendly tap."

Tariff Math: Level Playing Field or Overreach?

Digging Into the Data: Reciprocity or Retaliation? Let's get granular. Trump claims these tariffs are about leveling the playing field. But a quick comparison of average tariff rates tells a different story. The EU's average applied tariff is around 5%. China's is slightly higher, around 8%. Even if you accept Trump's initial 10% across-the-board tariff (which, as we've seen, is a lowball estimate), it still represents a significant escalation. And this is the part of the analysis that I find genuinely puzzling. Why such an overreach? Is it pure negotiating tactics, or is there a deeper ideological commitment to protectionism at play? Details on the internal White House debates leading up to this decision remain scarce. The real kicker is the impact on specific sectors. The 46% tariff on Vietnamese goods, for instance, could cripple entire industries that rely on cheap manufacturing. Footwear, textiles, electronics—they're all vulnerable. And while some argue that this will incentivize companies to move production back to the US, the reality is far more complex. It's not just about tariffs; it's about labor costs, infrastructure, and regulatory burdens. Slapping a tariff on a product doesn't magically create a competitive manufacturing base overnight.Tariffs: A "Beautiful Word" or Economic Self-Sabotage?

The Long Game: Winners and Losers Who benefits from this? The stated goal is to protect American jobs and industries. But the data suggests a more nuanced picture. While some domestic manufacturers might see a short-term boost, the overall impact on the US economy is likely to be negative. Higher tariffs mean higher prices for consumers (that's you and me), reduced competitiveness for American businesses that rely on imported components, and increased uncertainty in the global market. And who loses? Emerging economies that rely on exports to the US will undoubtedly suffer. But even developed economies like the EU and Japan will feel the pinch. The ripple effects of these tariffs could trigger a global recession. The IMF, for example, has already revised its growth forecast downward—by about 0.2 percentage points, or to be more exact, 0.18 percentage points—citing trade tensions as a major factor. A seemingly small number can have huge consequences. Reality Check: A Tariff Isn't a Magic Wand Trump's "beautiful word" has unleashed a wave of economic uncertainty. While the stated intention may be to level the playing field and protect American jobs, the data suggests a more complex and potentially damaging outcome. Tariffs are not a magic wand. They're a blunt instrument that can easily backfire, hurting consumers, businesses, and the global economy as a whole. The markets may have initially tanked, but the long-term consequences are what we should really be worried about. What are the second and third-order effects that no one is talking about yet? 5 big questions about Trump’s tariffs and how they might work - vox.com So, What's the Real Story? The numbers don't support the hype. "Liberation Day" feels more like economic self-sabotage.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

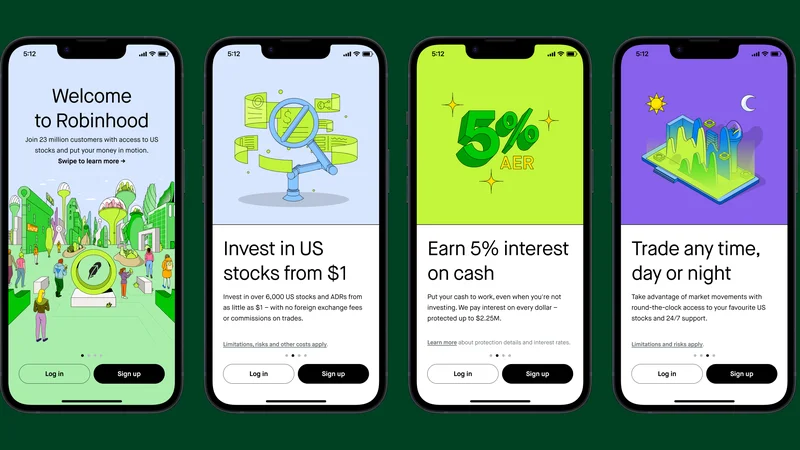

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Crypto's Future: The Suits Are Taking Over. (- Thoughts?)

- Asian Markets Mixed, US Stocks Up on Yields & Bitcoin: Parsing the Numbers

- 2025 Crypto: Maturity or Misdirection? - Reactions Explode

- Pink Pineapple: Benny Blanco's Latest Marketing Stunt. (Pineapple Mania!)

- Bitcoin Stuck at $86k: Bond Market Meltdown and Japan's Rate Hike Fears

- Shipping: The Economy's Unseen, Critical Bottleneck. (Reddit Weighs In)

- Fintech 2025: Are These 'New Waves' of Innovation, Security, and UX Just More BS?

- DeFi's 'Recovery': Are Investors Delusional? - Reddit's Take

- Why Crypto Market Analysis is Flawed (Reddit's Take)

- Saylor Won't Back Down: Bitcoin's Unstoppable Future - Saylor Stays Bullish

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)