Bitcoin Stuck at $86k: Bond Market Meltdown and Japan's Rate Hike Fears

10|0 comments

Bitcoin's "Dip"? More Like a Faceplant

Okay, so Bitcoin's at $86k. Big deal. Last time I checked, that's still a hell of a lot more than zero, which is what some of these shitcoins are worth. But everyone's panicking because it's down 30% from its October peak? Give me a break.

This whole crypto thing is just a giant game of musical chairs, and when the music stops, a lot of bagholders are gonna be left standing...or rather, sitting on a pile of digital nothing.

Bond Market Apocalypse: Godzilla's About to Stomp Tokyo

The Bond Market's Revenge The real story here isn't Bitcoin's little wobble; it's the bond market. Japan hinting at raising rates? That's like Godzilla clearing his throat before stomping on Tokyo. Global funding markets are about to get a whole lot less fun. 10-year Japanese government bond yields at a 17-year high? Someone's gonna feel that. And don't even get me started on China Vanke begging for a year's extension on their bond repayment. A year? That's like saying, "Hey, we *might* have the money by then, maybe. No promises, offcourse." The Chinese property sector is a house of cards teetering in a hurricane. Meanwhile, everyone's hyperventilating about the Fed cutting rates in December. As if a measly 25 basis points is gonna solve anything. It's like putting a band-aid on a severed limb. The ISM manufacturing index is still contracting, and everyone's cheering because it contracted slightly less than expected? Pathetic.Crypto Crash: Diamond Hands Turn to Paper?

Crypto Stocks Take a Beating Of course, the crypto-exposed stocks are getting hammered. MicroStrategy, Coinbase, Robinhood – they're all taking a beating. And those poor saps holding Marathon Digital and Riot Platforms? Their margins are getting squeezed like a lemon in a vice. But here's the part that really gets my goat: "Analysts at Bitfinex said recent losses in Bitcoin have triggered a wave of realised losses bigger than those seen at the two major lows earlier in the current cycle." "A market under stress and searching for liquidity as weaker holders capitulate." You don't say? So, the "diamond hands" are turning into paper hands, huh? Who could have possibly seen that coming? I mean, are we *really* surprised that people are selling when their magic internet money starts to disappear? It's almost like...wait for it...*it's not actually money*. Then again, maybe I'm the crazy one here. Maybe Bitcoin *is* the future. Maybe the central banks *are* doomed. Maybe I should just shut up and buy the dip. Nah. The Emperor Has No Clothes I'm not saying Bitcoin is going to zero. But I am saying that this whole charade is built on hype, speculation, and a whole lot of wishful thinking. And when the music stops, a lot of people are going to be very, very sad.-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

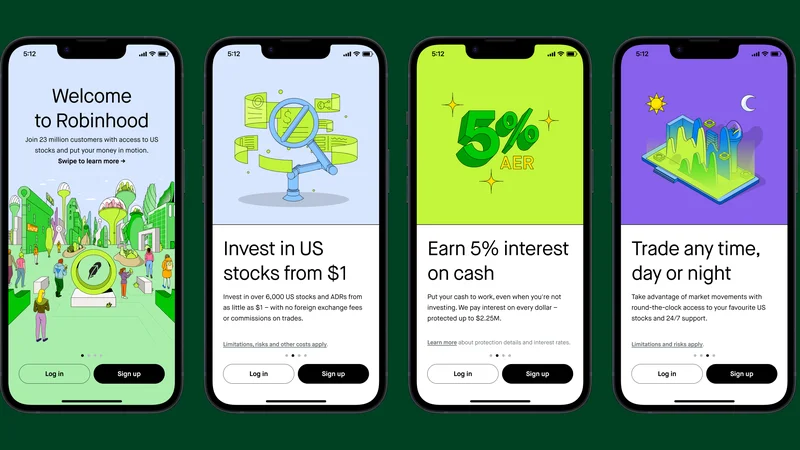

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Crypto's Future: The Suits Are Taking Over. (- Thoughts?)

- Asian Markets Mixed, US Stocks Up on Yields & Bitcoin: Parsing the Numbers

- 2025 Crypto: Maturity or Misdirection? - Reactions Explode

- Pink Pineapple: Benny Blanco's Latest Marketing Stunt. (Pineapple Mania!)

- Bitcoin Stuck at $86k: Bond Market Meltdown and Japan's Rate Hike Fears

- Shipping: The Economy's Unseen, Critical Bottleneck. (Reddit Weighs In)

- Fintech 2025: Are These 'New Waves' of Innovation, Security, and UX Just More BS?

- DeFi's 'Recovery': Are Investors Delusional? - Reddit's Take

- Why Crypto Market Analysis is Flawed (Reddit's Take)

- Saylor Won't Back Down: Bitcoin's Unstoppable Future - Saylor Stays Bullish

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)